Ripple (XRP), banking transactions to emerging markets

Ripple XRP is based in San Francisco California and has bases throughout the world. The ripple network was founded in 2012 and provides real time settlements of transactions instantaneously and securely.

Traditional financial institutions are slow and they have poor

security especially when transacting with emerging markets. The Ripple token

represents fiat, crypto and even air miles or basically any units of value.

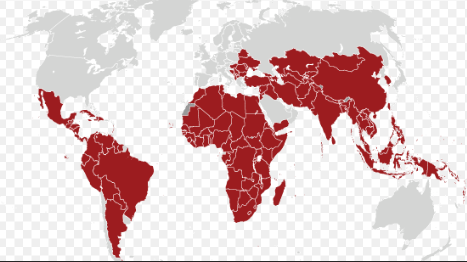

Emerging Markets

Transferring using banks is not cheap, as banks will charge high transactions fees for their services. In emerging or third world nations only 41% have bank accounts and 7% have credit cards. The banks in these nations are inefficient and expensive.

Although Ripple is not replacing these banks, they are making the banks more efficient and trustworthy settling transactions. Ripple can perform 1500 transactions per second as opposed to Bitcoins 7 transactions per second.

There are 150 institutional banks partnering with

Ripple seeing the benefits with their speed and customer satisfaction and thus

they have instituted Ripple and their XRP token.

ripples Proof of Consensus

Ripple uses a

consensus based model rather than the Proof Of Work that Bitcoin uses. The

users personal information is saved in the ledger, the ledger is kept up to

date every few seconds so when two accounts are verified and transacting no

information gets missed. Mining is not

needed to get XRP as Ripple issued the token themselves. The only way you can get XRP is to buy or

earn it.

Ripple still has some obstacles to overcome, the biggest being the banking industry is highly conservative and does not institute change quickly. This means that even though several have started using Ripple, the majority of them will find it hard instituting something this dramatic and new. One obstacle that they have overcome as they are now listed on all the major exchanges and they were just listed on Coinbase with coin pairs BTC, USD and EUR.

Ripple is unique

as it is a regulated token which allows it to partner with financial institutions. Currently cross border transactions can take

weeks and costs trillions of dollars so the potential for XRP as a solution is

huge.

In early 2019 Forbes reported that the Ripple model “is a giant pump and dump scheme” and that Ripple is obscuring this fact. The insider trading accusations have been contested by the XRP army. The simple fact is that we don’t know the answer.

Ripple has the potential to fill a huge niche in the banking industry, what people have to ask themselves is Ripple (XRP) worth the risk.

Recent Articles

-

Cryptocurrency is about to go mainstream, come find out why.

Feb 20, 22 11:33 AM

Cryptocurrency about to explode, as big money starts to invest these prices won't stay low for long! -

Theta Network

Feb 19, 22 11:14 PM

Theta technology solves the internets slow transmission speeds through incentivized bandwidth sharing. -

CryptoWallet tips and tricks and keeping your Crypto safe.

May 31, 20 05:17 PM

How to store your Coins in Crypto Wallet giving you peace of mind!