Bitcoin Trading, Tips and tricks in a volatile market!!

Bitcoin trading can be very lucrative as crypto is such a volatile market and the swings in prices can quickly double and triple your money. The opposite is also true, when a selloff happens it is often steep and can fall faster then it went up.

Trading is not for the timid. It also isn't gambling or being dumb, it is very important that the money you trade with isn’t money you can't afford to lose. This is the one area you can make generational wealth with a small percentage of money so there is no need to go into debt or use money you need for rent or to eat.

Day Trader warning

Just a word of warning, 90% of day traders lose money while 80% quit within the first 2 years. The day trading approach is not recommended unless you have time, passion and knowledge. This site is about finding good coins to enter while they're cheap and hodl (hold on for dear life) while waiting for the big money to arrive.

|

Bitcoin charts and how to spot trading patterns! |

Crypto holders have to be able to suffer through huge trends up and down and still be able to sleep at night. Make sure that you allocate to this market what you are willing to lose. You don't need much to reap the benefits of the upswings, but you have to be willing to endure the volatility and downswings also. |

bitcoin trading goals

Bitcoin Ticker Central Hub for tools to help find the best trades! |

Lets start out with the main goal of trading. Buy low and sell high. Baron Rothschild is credited with stating “the time to buy is when there is blood on the street”. This is a very true statement when it comes to bitcoin trading. The opposite is to be able to sell when the people who own coins are in euphoria as it increases exponentially right before the top. In fact exiting a rising stock is more of a challenge then buying at the right time. |

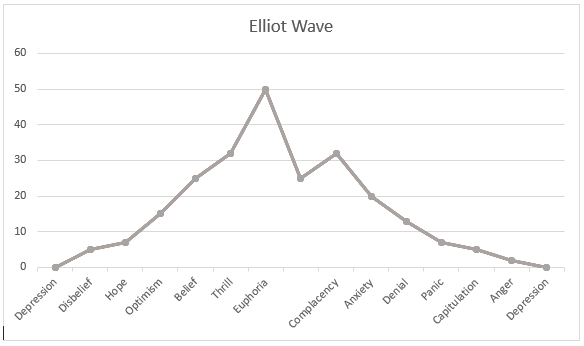

Psychology doesn’t change, people react in patterns when stocks rise or fall. Here is a chart that you can use to compare to trends in alt coins. In the 1930's people thought the stock market was random ups and downs until Ralph Nelson Elliot found patterns as shown below.

elliot wave & emotional patterns

I have gone through this cycle and I can truly say my emotions were very similar. The insiders with the most influence over the money know this well and will take advantage of the emotionally invested masses.

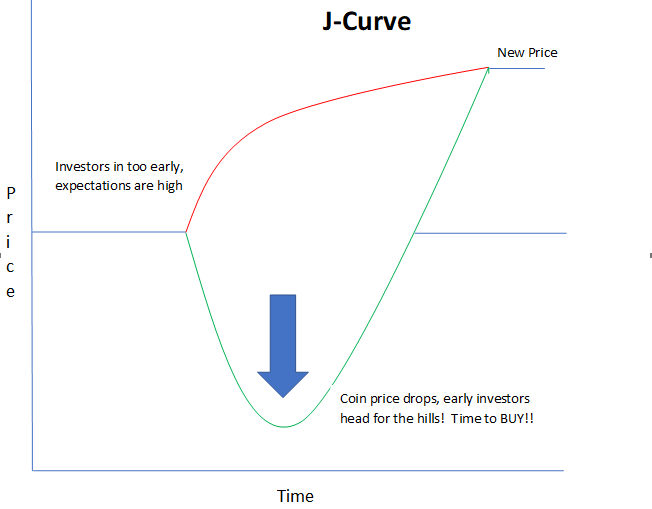

The chart cycle for bitcoin trading is super fast as compared to the stock market which can take years going through this same cycle. So as others are in the Depression phase which is the bottom of the J curve, my logic is to BUY (obviously)!

This is not financial advice in any way, everyone has a unique situation and needs to do their own due diligence, I just hate seeing the unsuspecting masses lose over and over. I have decided to curb my emotional investing with a more objective and knowledgeable perspective. Here are a few things I have discovered researching the best and brightest in the business and through my own experiences.

I am looking for stocks with this J-curve quality, the depression phase being the low point and sticking around through the suckers rally and then follow the curve back up.

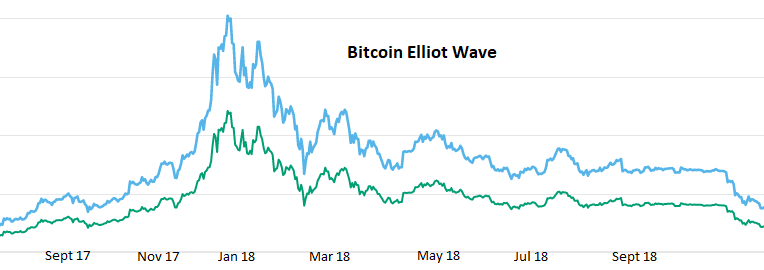

The following is an actual capture of Bitcoin From the beginning of 2017 thru 2018. Can you see that the psychological pattern is very similar to the Elliot wave.

How to spot a j-curve

Bitcoin trading essentially comes down to knowing when to enter in at the lowest point before the upswing. Although this appears easy, there is quite a bit of due diligence that needs to be done before entering a trade in the depression phase of the j-curve.

The fundamentals of a crypto startup are key to picking a good crypto as opposed to the 90% bogus coins that will be gone in short order. From White papers to roadmaps, future coin inflation to community loyalty, digging down is important before considering a coin to buy.

|

Bitcoin Fundamentals! How to pick winning Cryptos |

The fundamentals of a crypto startup are key to picking a top notch alt-coin as opposed to the 90% bogus coins that will be gone in short order. From White papers to roadmaps, future coin inflation to community loyalty, digging down is important before considering a coin to buy. |

technicals & price action

|

Price Action and Finding the Smart Money! |

Secondly the technicals of a coin are also important to have a better idea of where the opportunity is by finding patterns. Just as important is where the smart money is accumulating. This includes a good strategy to get out while still close to the top which could be the most important part of trading. |

Finally it can be hard to digest exactly how to apply this in real

life. There are many moving parts when it comes to charts, quality of crypto companies and actually digging deep into the crypto itself.

Please sign up for the free newsletter at the top of this page and keep checking for updates on this site to stay ahead of the latest crypto news, trends and other important information on crypto!

Recent Articles

-

Cryptocurrency is about to go mainstream, come find out why.

Feb 20, 22 11:33 AM

Cryptocurrency about to explode, as big money starts to invest these prices won't stay low for long! -

Theta Network

Feb 19, 22 11:14 PM

Theta technology solves the internets slow transmission speeds through incentivized bandwidth sharing. -

CryptoWallet tips and tricks and keeping your Crypto safe.

May 31, 20 05:17 PM

How to store your Coins in Crypto Wallet giving you peace of mind!